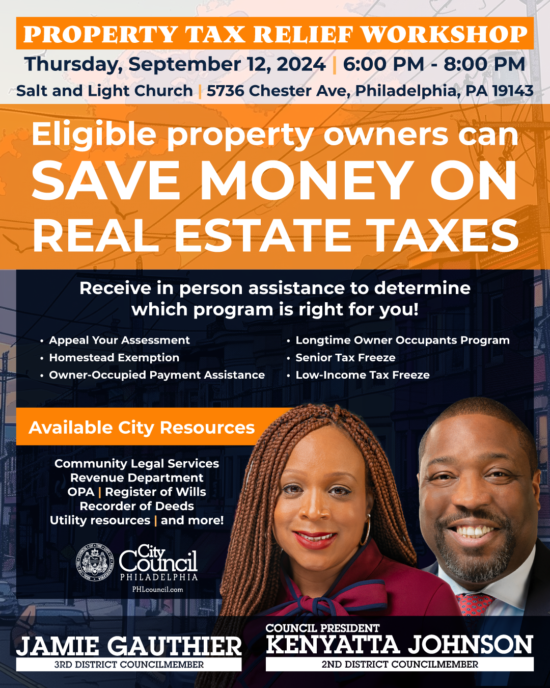

City Council is hosting a tax relief workshop this Thursday, Sept. 12, in Southwest Philadelphia to help residents whose taxes have gone up in recent years.

The workshop, presented by Council President Kenyatta Johnson (2nd District) and Councilmember Jamie Gauthier (3rd District), will take place in the Kingsessing neighborhood, which, according to an analysis by the Philadelphia Inquirer, saw the highest increase in property tax bills for single-family homes anywhere in the city.

The workshop will be held at Salt and Light Church (5736 Chester Ave) from 6-8 p.m.. Residents can get in-person assistance with tax relief programs and property assessment appeals.

To keep families in their homes, City Council provided more homeowners with property tax relief than ever before. Council and the Mayor enacted Councilmember Gauthier’s low-income property tax freeze, which keeps property taxes for eligible and enrolled homeowners at their current (pre-2024 assessment) level. Council President Johnson also led the successful expansion of the Homestead Exemption from $80,000 to $100,000.

For more information on these and other real estate tax relief programs, visit: https://www.phila.gov/services/payments-assistance-taxes/taxes/property-and-real-estate-taxes/get-real-estate-tax-relief/

September 13th, 2024 at 5:03 pm

Homeowners are stealing directly from public schools when they try to evade taxes.

September 16th, 2024 at 2:03 pm

I take the Homestead Exemption and I am not ashamed for it.

We live in the 5th highest tax per capita city in the country. I don’t feel that rich. Perhaps Gauthier and Johnson can tighten their belts instead.

https://www.pewtrusts.org/en/research-and-analysis/reports/2019/03/20/the-cost-of-local-government-in-philadelphia

September 16th, 2024 at 8:10 pm

Taking a homestead exemption when you can afford to pay full property taxes is a morally indefensible act that perpetuates systemic inequality.

Homeowners, many of whom already enjoy significant wealth, are shielding themselves from their fair share of taxes—funds that are desperately needed for public schools in under-resourced communities. By taking advantage of this exemption, they are effectively starving schools of vital resources, denying children, particularly those from marginalized backgrounds, access to quality education.

This is not just a financial loophole—it’s an act of selfishness that undermines the social contract and contributes to the racial and economic disparities that plague our education system.

Those with the means to pay must do their part, rather than hoard wealth at the expense of the most vulnerable.

September 17th, 2024 at 8:31 am

Don’t say!

and the fair share is determined by…you? Mr. Johnson?….

No thanks.

September 17th, 2024 at 9:42 am

Taking a homestead exemption in a poor, gentrifying city reinforces systemic racism and white supremacy by enabling wealthier, often white homeowners to avoid contributing their fair share of taxes, which disproportionately harms communities of color.

Gentrification displaces long-time residents, most of whom are Black and Brown, while increasing property values that benefit wealthier newcomers.

By taking this tax break, homeowners like you perpetuate the racial wealth gap, as funds that should support public resources, like schools in under-served neighborhoods, are siphoned off for the financial benefit of the privileged, further entrenching racial and economic inequities.

September 17th, 2024 at 2:40 pm

are you sure?

https://property.phila.gov/?p=361017305