It’s no secret: property taxes for many in West Philly, especially in gentrifying neighborhoods, will increase beginning next year. Some will see dramatic increases under the city’s new Actual Value Initiative (AVI), which is designed to rectify disparities in assessed home values.

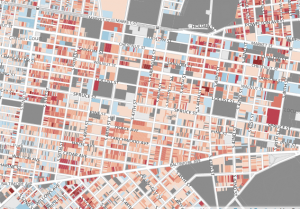

Check the assessed values of nearly every plot in the city using the clickable and zoomable map below.

Some estimates put the number of property owners who will see an increase at about 60 percent. Most of those will be modest increases. But residential properties on some blocks will see their taxes double – or more. For example, property taxes on the east side of the 400 block of 51st street could rise as much as 270 percent. A caveat is in order here. Although the assessed values are right, the map is based on a 1.34 percent tax. City Council will set the actual rate in the spring and will also consider relief measures for the hardest hit property owners.

Property owners can also appeal assessments (see “AVI tools and resources” below).

Property owners will receive new assessments this week by mail, but the assessments are already accessible online thanks to the city’s efforts to make home values transparent. The clickable map below produced by the non-profit news and information organization Axis Philly shows the new assessed values. The darker the red, the higher the likely increase. If the property owner received a homestead exemption, that should be noted on the map.

Obviously, it’s too early to predict how these new values may impact neighborhoods. Part of the appeal (and higher sale prices) of homes in “up and coming” neighborhoods in the city like Fishtown, Graduate Hospital, Powelton Village and University City were low property taxes. So the tax increases themselves will likely impact sale prices (and “actual value”).

For property owners who live within the Penn Alexander catchment, the new assessments come on the heels of an announcement from the School District of Philadelphia that the school will implement a kindergarten registration lottery. The school has already said that spots in the elementary school are not guaranteed for new children in the catchment.

Many renters could also see a bump, depending on what type of property they live in. Many large apartment complexes will see a drop in assessed value and their taxes, while homes converted into apartments are more likely to see an increase.

Large commercial properties will likely see the biggest drop. Taxes on the CVS property at 43rd and Locust, for example, could drop as much as 20 percent. But many properties that house small businesses will not fare as well.

How will the new assessed values impact you? Will it drive people and businesses out of your neighborhood?

The clickable map (press “collapse” to reduce the size of the search window):

AVI tools and resources:

• Pew Report: The Actual Value Initiative: Overhauling Property Taxes in Philadelphia.

• Appeal your assessment

• AVI Calculator

• Newswork.org’s Taxipedia.

– Mike Lyons

February 18th, 2013 at 1:30 pm

Does anyone know if/how homeowners are still able to apply for the homestead tax exemption? I didn’t pay much attention to it when the papers came this summer, but did not realize we were facing a $2,100 tax hike.

February 18th, 2013 at 1:43 pm

Yes, you can apply through July 31, and you can now apply online.

http://www.phila.gov/OPA/AbatementsExemptions/Pages/Homestead.aspx

February 18th, 2013 at 1:51 pm

Whew, thank you!

February 19th, 2013 at 12:21 pm

How does this affect apartment buildings in the area, and the rents charged to their tenants?

February 21st, 2013 at 1:14 pm

@Timothy- Some apartment buildings will see an increase and some will see a decrease. From a quick glance, it appears the vast majority will see increases. It is likely that landlords will pass at least a portion of these increases on to tenants, so you can expect to see rents increase.

February 22nd, 2013 at 2:27 pm

I bet all rents increase regardless of tax decisions.