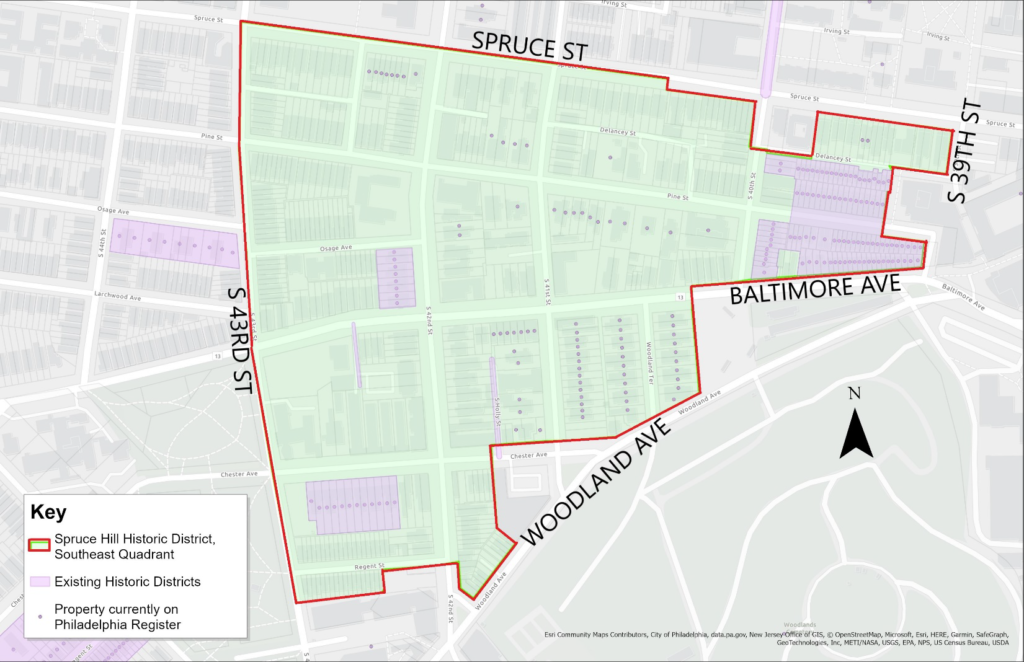

Saint Joseph’s University (SJU) is selling multiple properties on and near its University City campus (formerly University of the Sciences), after an unsuccessful bid to find a single buyer for the entire campus, according to reports.

Saint Joseph’s University (SJU) is selling multiple properties on and near its University City campus (formerly University of the Sciences), after an unsuccessful bid to find a single buyer for the entire campus, according to reports.

Earlier this month, SJU put up for sale five properties, including the off-campus student housing building, Osol Hall, located at 510 S. 42nd Street. It has now added seven more campus buildings to this list, according to Philadelphia Business Journal, including the Athletic Recreation Center, the main parking lot and green area (the Quad), the Wilson Student Center, the Joseph England Library, Goodman, Hall and Alumni Hall. These properties have a combined assessed value of $58.45 million, according to Philadelphia tax records.

Recent Comments